Big online businesses have heavily invested in analytics and big data to understand the consumers' shopping and buying habits. From the online shopping process to making payments, these online businesses have realized that customers desire an easy and intuitive experience that caters to their unique shopping experience. Consumers have increasingly turned towards payment methods that allow for quick transactions depending on the context.

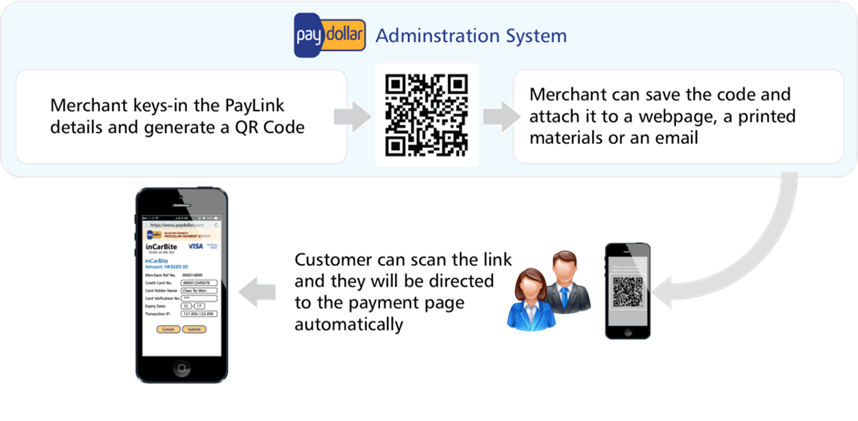

The market for QR code payments has vast potential; It's a quick and easy way to accept payments, especially in retail, hospitality, e-ticketing, toll payment & parking, and lastly, SMEs verticals. Progressive retailers who intend to improve customer experiences will be the ones taking lead with this payment option evolution.

QR code payment has rapidly proliferated in frequently underbanked markets in Asia

In the context of the rapid development of the Internet economy, the increasing popularity of smartphones, QR code payment is playing an indispensable role in people's lives. Industrial experts have forecasted that 1.31 billion people are predicted to use a mobile payment app worldwide by 2023. The Covid-19 pandemic has fueled Asia’s future in digital payment. According to a report by McKinsey & Company, there is an 80/20 rise in digital payments. That means the digital user base has seen a 20% increase, where 80% has registered during the peak of Covid-19. The trend has expected to remain for the long term.

Benefits of using QR codes

QR code payment has high efficiency and low cost

In seconds, payments are being processed. At the same time, merchants do not need to transform the existing hardware and software on a large scale. QR code payment can simply be upgraded on the POS machines and smartphone, and the cost borne by individual merchants is significantly reduced.

Convenient and contactless payments are certainly at the forefrontThe quick convenience of payment experience is one of the most direct experiences of QR code payment users. It changes the traditional payment model of cash and credit card.

Safer and easier checkout experience, customers only simply tap a mobile network device such as the smartphone to scan the code without needing their signature. In a fast-paced society and digitalized world, the need for convenience is greatly enhanced. This mode directly establishes a fund transfer relationship between users, merchants, and third-party platforms-which saves time, transportation costs, and complex handling charges.

Allow merchants to accept more payment methods and promote customer engagement

Engage consumers through personalized offers and messaging that can be embedded in the QR code. It could be part of a merchant’s rewards program to drive engagement and revenue.

Now you can connect with our local expert sales team for more QR Code Payment updates on how to upgrade your business thrive in these uncertain times. Get started with simple and convenient payment processing today.